Introduction

The wine industry in Oregon is thriving. Since 2000, the number of vineyards in Oregon has more than doubled, and the number of wineries has increased nearly six-fold. As the industry has grown, so too has recognition and accolades for Oregon’s wine. Although Oregon wines still account for only 1% of US domestic wine production, they made up 20% of Wine Spectator’s 90+ scores between 2015 and 2018.

The wine industry’s growth translates to a positive impact on Oregon’s economy, helping to uplift Oregon communities, particularly those in rural areas where much of Oregon’s grape growing and wine production occurs. Full Glass Research estimated that in 2016, Oregon’s wine industry contributed $5.6 billion to the state’s economy, supporting around 30,000 jobs that paid around $1 billion in wages.

Currently, we estimate that about one-quarter of Oregon’s wine sales are direct to consumer, but for many small-to mid-sized wineries, direct to consumer channels often account for a much higher proportion of sales. Tasting room purchases dominate as the venue for direct to consumer sales.

Given the importance of direct to consumer sales (particularly in the tasting room), coupled with the estimated $787 million that wine-related tourism contributes to the state’s economy, it has become increasingly important to understand the characteristics and motivations of Oregon’s winery visitors.

Overview

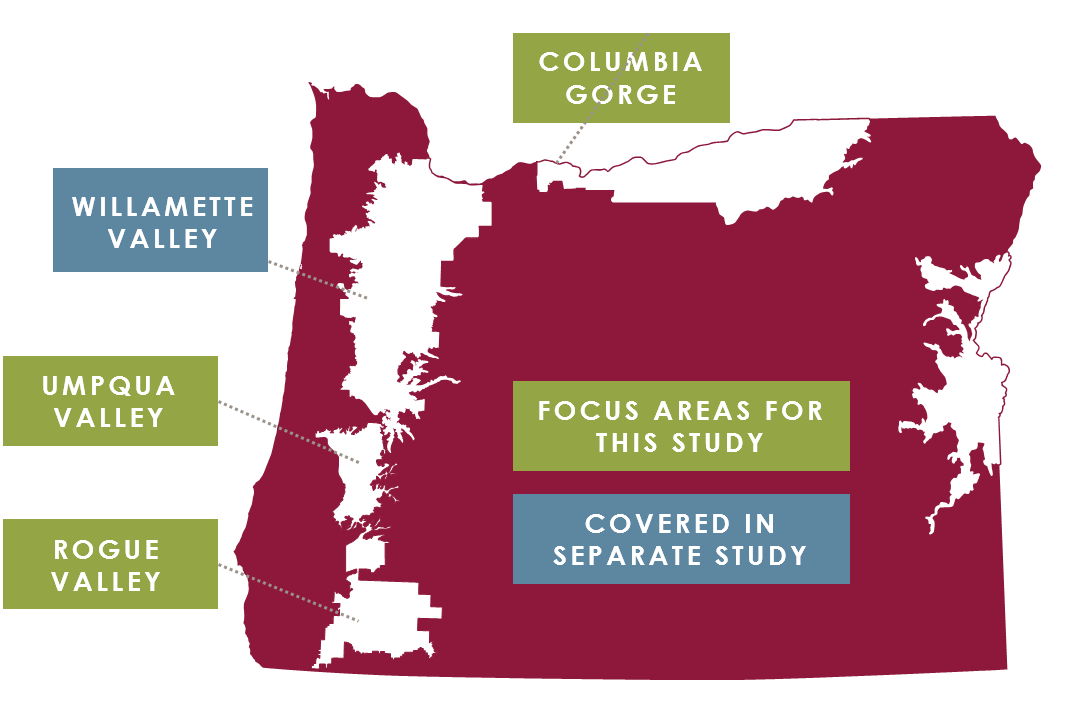

From the summer of 2018 through the spring of 2019, the University of Oregon’s Institute for Policy Research & Engagement (IPRE) worked with the Oregon Wine Board to conduct a survey of visitors to three of Oregon’s major wine regions:

- Rogue Valley

- Umpqua Valley

- Columbia Gorge

Parallel to these efforts, the Willamette Valley Wineries Association surveyed winery visitors in the Willamette Valley (see the report). Both projects were made possibly part an Oregon Wine Country License Plate Matching Grant.

The extensive survey administered by IPRE asked winery visitors to provide details of their trip and travel habits, including information about travel patterns, trip activities and spending, and satisfaction with their experience. The survey also investigated visitors’ perceptions of each wine region in comparison to other wine regions and considered visitors’ preferences for various tasting room attributes. This report provides a summary of key findings from the survey research.

Report

In addition to describing characteristics of winery visitors such as their demographics, travel behaviors, spending habits, and perceptions of each wine region, IPRE has compiled broader findings from their research beyond this study. This work includes including emerging trends in winery tourism and specific preferences and behaviors that wine industry and travel professionals should consider as they work to strengthen Oregon’s wine sector.

Report Contents:

- Visitor Demographics

- General Trip Behaviors

- Wine-Specific Trip Behaviors

- Trip & Wine-Specific Spending

- General Regional Perceptions

- Wine-Specific Regional Perceptions

- Findings and Trends from External Research

- 19 Visitor Personas

Data Tables

Use the links below to download PDF files of the data for each region.

Columbia Gorge

Rogue Valley

Umpqua Valley

Combined Data

Partners

This project was conducted in partnership with researchers at the University of Oregon’s Institute for Policy Research and Engagement. Learn more about the IPRE.

This project was made possibly by an Oregon Wine Country Plates Matching Grant. Learn more about Travel Oregon’s matching grant programs.

Leave a comment